Personal Finance | Ratios You Must Know - Key Personal Finance Ratios

Personal finance is not the roulette wheel - it is not a game of chance. Personal finance is calculated and studied. Understanding financial ratios in business is key to being able to set goals and benchmark your progress. Understanding the benchmarks of your own personal finances is critical too for your success for both you and your family's long term financial success and stability.

One of the key items in finance is the power of compound interest. Albert Einstein (March 14 1879 – April 18 1955) was a world-renowned physicist whose name over time became synonymous with genius not just because he was brilliant but also because he was original. One of my favorite quotes attributed to Einstein is "the most powerful force in the universe is compound interest." Essentially if you fully understand the power of compound interest, you will have achieved 90% of the knowledge base for best managing your own personal finances. Interest can earn you money or as we have seen cripple you and your family emotionally and financially.

"Every man is the architect of his own fortune."

— SallustRoll of Chances - Roulette Wheel

Finance - Understanding Not Memorizaation

Another of my favorite quotes from Einstein is essentially "don't memorized something you can look up." Understanding the principles of finance enables you to make better decisions and to guide you and your family through both the good times and also the bad economic times.

In essence, finance is simple and straightforward, it is not a roulette wheel, you have complete control - you are the captain of your own destiny. The key is to understand how to read the road map. With a little bit of learning, you too can be the captain of your future, in complete control - not bound by the whirl and the luck of the roulette wheel.

Personal Finance Famous Quote

"The most powerful force in the universe is compound interest"

— Albert EinsteinNet Income Margin Percentage

Net income margin is a valuable benchmark and is expressed as a percentage, expressed as a percentage of your total income. On the business side it is called net profit margin.

Net income margin formula:

Net income x 100 ÷ Total revenue.

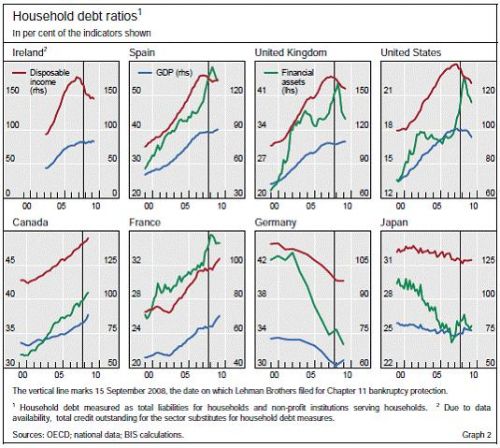

Global Household Debt

Companies gauge their success by their profit margin. In a similar manner, we as individuals can quantify our free income by calculating our Net Income Margin.

Net Income Margin is calculated by taking your net income divided by your total income. For example, if you made $40,000 and after all the expenses your net income was $2000 dollars for the year. The formula would be $2,000/$40,000 or 5%.

For businesses, if they had a 5% Net Income Margin it would tell them that for each dollar of income, $.05 would be profit, in the business world the term is Net Profit Margin.

The importance of this benchmark is this - similar to a company, more income may not mean more profit. If you moving to a more expensive part of the country, if you must maintain two residences to take the new job that offers a larger salary, do the full calculation and see if after ALL expenses, are you ahead? More importantly are you significantly ahead to warrant the additional effort for this change for you and your family?

A word of caution - don't be short sighted. An associate of mine took a position with a 50% pay decrease during this economic decline. It was an opportunity for the future and to allow him to continue to pay the bills. The safety net was if all else fails, at least it is easier to get another job when you have a job. So the moral of the story is to view the calculations in the grand scheme of your life. What is best for the short duration may simply be a stepping stone that will pay large dividends. Incidentally that 50% pay decrease did pay off - he now has ownership within that start up company and his equity in the company is equal to $300,000. His salary cut from $150,000 to $90,000 for the two year interim period proved to be a fruitful investment. And if he had no stock earnings? Well, he still has a job and has an easier time jumping to the next position when he is fully employed.

“Money frees you from doing things you dislike. Since I dislike doing nearly everything, money is handy.”

— Groucho Marx“Creditors have better memories than debtors,”

— Benjamin Franklin

Insecure Consumers

"As an example of insecure consumers caving in to the commercialization of identity, there's One Perfect Day: The Selling of the American Wedding which is now like education--you have to indebt yourself for years (or life) just to get a college degree or the perfect wedding. Gag. It costs $50 or whatever to have the judge marry you, folks. Then go home and throw a party. Your happiness will not be impinged one bit." Charles High Smith

“Creditors have better memories than debtors.” – Benjamin Franklin

Debt to Asset Ratio

Personal finance is all about managing expenses. All too often our income is dictated by our paycheck. Just as Einstein stated, the power of the compound interest is a great force and a force to fully understand and actively manage.

For a business, if they own more assets than liabilities, they have a debt ratio of less than one. If their debt ratio were over 1, they would have more liabilities than assets. This is a critical measure of a company's long term viability. Couple this with cash flow and you have a good overall view of the company's financial picture.

The same is true for us as individuals, the debt to asset ratio is a benchmark we must watch. During the skyrocketing home prices, one of my bosses congratulated me on the growth in value of my home. I replied and keep in mind this is during the height of the frenzy, that the growth only means more property taxes for me - until the asset is cashed, it is only a paper value.

Sadly, all of us in this market have learned this lesson the hard way.

My mother had a great saying that I have sought to live by. You never go broke taking a profit. Yes, it may look as if there is more money down the road but selling an asset for a profit is always a wise move.

The moral of the story here is track your asset and debt values. Know what you have outstanding.

And to all husbands and wives take note, keeping financial secrets is akin to murdering your family. A college friend received her first apology from her husband last week. Why? Because he ran up credit card bills which disqualified them for taking out a loan for their daughter's college education. Family finances are a team effort. What you do will affect the entire family. Full disclosure is absolutely necessary.

Take Our Poll - Your Opinion Counts

Do you feel our personal debt is a reflection of our emotional insecurity?

Credit Card Trap

Credit Card Fees and Compound Interest - A Spring Trap

The photo to the right is very wise. Credit cards will sneak up on you and bite you - hard! As Einstein stated it is the power of the compound interest. Add in excessive fees and the bills mount uncontrollably.

No Business Credit Cards

To protect yourself and your family, be advised that personal credit cards have more protection now than business credit cards. If you run a small business, designate a personal card for business expenses only. This will provide you with more protection for excessive fees and high interest rates.

I know the offers arrive almost daily, simply throw out ALL business credit card offers - it is not worth the risk.

Credit Education

"Student's perceptions are catching up with reality. As college juniors and seniors are about to embark on life after college, they're starting to realize they could use more credit education information and resources to help make smart financial decisions. It's critical for college students to learn responsible personal finance management early to build a strong credit history, which they'll need to help establish their lives after college."

Jeff Schumacher quotes

Cash is King - Cash Flow to Income

In corporate finance, one of the key items is not just revenues and debt to equity, it is the amount of available cash on hand. You see, cash is king. Cash and purchase added inventory, cash can purchase added investments, cash can carry you through the hard times.

"Cash is king" is also true for personal finance.

Cash allows you as an individual to be free. If you can fully pay off your credit card balances each month, your cash flow is doing well. If you can fully pay off your credit card balances and increase your savings month by month, that is one giant step better.

Life has surprises for both you and your family. Cash cushions the difficult surprises that life throws at us.

A safety net of investments is always good. Fully paying off your lines of credit, credit card statements is good, having cash on hand remains the best of the best - cash is truly king - both in the corporate world and in your personal finance.

Corporate Finance - Operating Cash Flow

In corporate finance, operating cash flow, also known as OCF is not the same thing as net income. OCF is derived from net income through a series of adjustments to working capital accounts on the balance sheet.

OCF is an accountant's method of recording how cash flows into and out of a company. In essence, if more flows in than out, the flow is positive, if not, the flow is negative. Cash flow is an important part of every corporate financial statement. Cash flow showcases the stability of the company even more than the balance sheet.

In our personal lives, we too can feel the efforts of cash flow. As parent write large check for college, as new college grads pay off student loans, as you pay for your first home or automobile, you feel the cash flow every time you view your cash statements.

Yes, there is emotion connected to money. That is a critical part of personal finance.

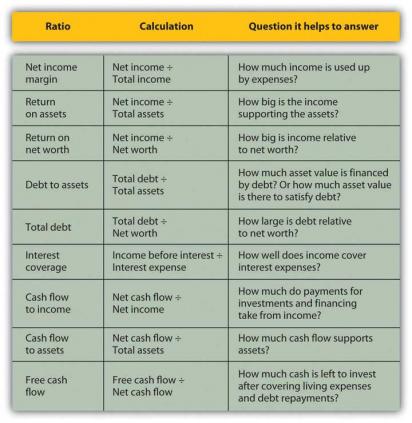

Ratios and Calculations

Being Rich is About Options

"Being rich is not about a lot of money, it is about a lot of options."

Chris Rock on CBS Sunday Morning

Money is Manageable - Money Means Opportunities

Your income, your assets are not an item left for the Chinese fortune cookie.

Money is manageable.

The more you know the better you can manage your family's finances.

Study the formulas and learn the benchmarks and you will be on the pathway to financial success.

Quick Personal Finance Quiz - What You MUST Know

view quiz statistics© 2011 Ken Kline