10 Money Saving Tips - Best Practices Personal Finance | Smart Saving | Balance the Family Budget

10 Tips to Balance the Family Budget

Saving smartly during trying times. Saving smartly during great economic times. Saving smart is a mindset, a way of living. Living within our means places less anxiety upon us and sets clear boundaries. Yet, if we were not raised in this manner, it can be confusing.

Making financial choices can be made very clear - if you are handed a road map.

Sadly, many families have showered gifts with no financial boundaries. How can the individual get on track when they were not raised with these values?

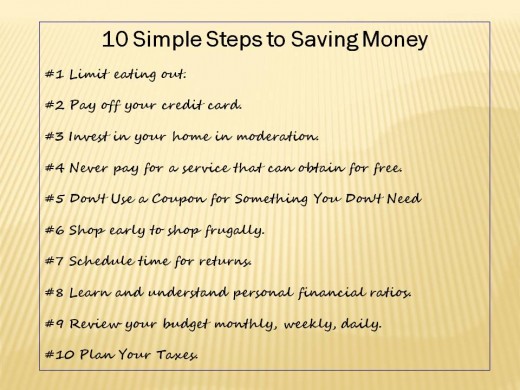

Here are 10 simple tips to get you started in the right direction on your financial journey. The most important key is your team. You need your family, your spouse, your significant other, your best friend to also understand these principles of frugality. Learn how to decipher your financial priorities. Yes, many are the standards you have heard before, but they are principles that must be emphasized and not overlooked. Check out 10 simple steps to saving money.

Make It At Home - Eat At Home - Create Treats At Home

Famous Quote About Avoiding Debt

Money Saving Tip

#1 Limit Treats - Limit Eating Out

This is perhaps the hardest for fast paced families. However, this is the first area where we can make a significant dent in our savingsgs. Just changing up our routine and making eating out special rather than a regular routine will strengthen the stability of your checkbook and long-term savings.

The media has trained us that we deserve a "latte" at the coffee shop. Yet, how is the Italian caffè latte or as the Americans commonly say "latte" any different than an ice cream cone? Let's save the latte in the same category as the ice cream cone and reserve it for special time with friends. This means no routine stops daily or weekly. A special treat reserved for monthly or quarterly for special events not weekly/daily events with friends and family.

Italian caffè latte

Pennies Add Up to Substantial Savings

Famout Quote About Saving Money

Pure Filtered Water Right at Home

Little Items Count Allot

The one item that we take for granted is the stop for coffee. The latte at the corner coffee shop is filled with enough calories that we might as well be eating ice cream. More importantly, that coffee often is upwards of $3 and even $5. Limit your treats, take your coffee with, travel with bottled glass ice tea for your hydration and your savings will literally soar.

Stay Hydrated with Your Own Water

Staying hydrated is important. Often you are not hungry, you are dehydrated. Plan ahead and you can save significant dollars on the cost of beverages and bottled water.

Cooler in the Car - Plan Your Treats

Set up a cooler in your car for your favorite beverage, favorite treats. When I travel across the state, my wife prepares a small lunch size cooler bay with my favorite soda, some fruit and other quick treats we have in the house. I suspect she does this to hurry me home more than save money. She knows I am goal orientated and will simply want to get from point A to point B. Yet, the dollars that can be saved are substantial.

Calculate your Weekly or Daily Indulgences Annually

This relates back to rule number one but is a specific step for analyzing your personal finances. If you have a family, it is the job duty of all family members to discuss this important calculation.

If you stop for a latte every Wednesday and it is $5, know that your annual spending for that is 52 weeks of the year would be 50 x 5 + $250 (assuming two weeks are skipped). Ask yourself if that latte worth the annual $250?

Likewise with entertainment. Know where you are spending your dollars. Cable television, text messaging, cell phones add up - know not just the monthly amount, calculate together the annual amount.

Pay Off Your Credit Card Before You Drive Over the Cliff

Money Saving Tip

#2 Pay Off Your Credit Card

If you cannot afford to pay off your credit card you are on a dangerous road. If your credit card includes purchases such as food and restaurants and you carry a balance, you are not only on a dangerous road, you are headed directly toward the cliff. Turn, stop, slow down. This is a danger signal you must listen to - your financial life depends upon it.

2011 Home Improvements for DIY - ROI

Money and Your Home

Money Saving Tip

#3 Invest in Your Home in Moderation

The best financial scenario is to have the smallest home in your neighborhood, preferably in the best possible neighborhood you can afford. The worst situation financially is to over invest in your home. A client of mine update their kitchen and now with the market downturn realizes they will not be able to move for at least 10 years or when then the economy rebounds.

The rule I live by is to never put so much into your home that you cannot afford to sell it today. Likewise, maintenance items that must be done prior to selling take a priority with the family budget. Don't live your life in a state of panic, plan ahead. Do the simple handyman jobs and paint jobs on a routine basis. Always have your home in a state IF disaster struck, you would be able to comfortably place your home on the market within 30 days.

In regards to maintenance, remember, roofs and windows do count. New carpet is a checkbook item you can buy anytime, roofs and windows you live with and can cost you money in heating and possible structural damage. Roofs and windows must be maintained.

Money Saving Tip - Don't Pay for a Service You Can Obtain for Free

Money Saving Tip

#4 Never Pay for a Service that Can Be Obtained for Free

Wal-Mart's coin service looks like a great convenience, but if you are saving your pennies, it is the wrong place to convert your change to currency.

Take your change to the bank where they will convert it for FREE! Yes, I said free.

The cost for me to empty our piggy bank at Wal-Mart's Coinstar can be double digits as shown in the receipt depicted above.

If you are considering this option, DO ask the rate before you dump your coins in that convenient machine. Most likely, you will this convenience simply does not pay.

Take Control of Your Purchasing Decisions

Money Saving Tip

#5 Don't Use a Coupon for Something You Don't Need

Coupons can save us big money yet if we are buying for the sake of the coupon - beware, you are being trapped. You see, this is the purpose of the coupon - to increase the volume of sales by teasing you into buying what you don't need.

Likewise, don't join a wholesale club or store IF you don't need the volume for your family. Plan your purchases, don't let the coupons control you.

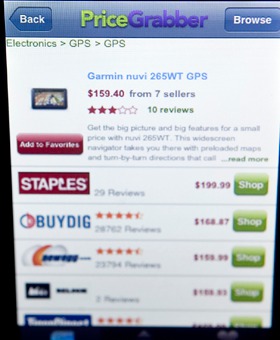

Comparison Shopping

Money Saving Tip

#6 Shop Early to Shop Frugally

Last minute shopping is panic shopping. You ignore the expensive shipping costs, you don't look for the sales. Shopping early allows you to combine purposes, team with family members to combine shipping charges and sometimes allows you to buy in bulk. For families with children, this is even more critical. Your time and your dollars are limited and always strained. The wholesale clubs offer a great value but again panic must be avoid. Always plan your purchases.

DO Shop Early and DO Compare Prices

Do shop early and do compare prices. Having a list is helpful so you don't overspend and accidentally forget someone.

DO Shop With Your Smart Phone to Compare Prices

Comparison shopping has gotten much easier with your smart phone. Do look for those great mobile applications that allow you to conveniently compare.

DO Shop Online or By Catalogue

Shopping online allows a great convenience for comparison shopping and it also avoid the expensive temptation to stop for something to eat.

Light a fire in the fireplace, cuddle up and pick up your smart phone and settle in with your shopping list and make the season and the many gift giving chores brighter.

Money Saving Tip - Know the Return Policy Before Purchasing

Money Saving Tip

#7 Schedule Time for Returns

Returning unwanted items is critical to your checkbook. Retain your receipts and set aside one day a week IF you have a return, that is the day of the week for the return. This allows you put the item aside, review your purchases on a weekly basis and do your errands in an orderly basis. Remember a number of store will not accept a return after 30 days. When shopping on eBay follow the store keepers rules to the letter. Take a mental note of what you need to do and how quick you must make your final decision on that item.

Know the Return Policy Before You Buy

This is especially critical on the Internet because shopping online has different time frames. eBay is one of the places where I have made it a personal policy to never even bid on an item until I know the return policy.

Money Saving Tip - Know Your Personal Ratios

Invest in Knowledge

- Personal Finance | Ratios You Must Know

Control of your future is within your fingertips. Personal finance is not difficult, if you understand how to read the road map. The rules are straightforward and simple. Once you understand the principles, you are the master of your future. Take con

Money Saving Tip

#8 Learn and Understand Personal Financial Ratios

College education and driving a car is a privilege, managing your money on the other hand, is a necessity for each and every one of us. Take the time to learn what the personal financial ratios are and what they mean to you and your family. Discuss finances openly with your family.

During the economic crash, an exceptionally wealthy client of mine relayed a statement made by their young son. He was aware of the economics happening around him but clearly had never been briefed on the family finances. He came home from school and asked his very prosperous and wealthy family IF they were broke! Families of all economic classes must engage in regular discussions about the family income. The exact dollars do not need to be relayed but a general concept of the level of your income in respect to your immediate community and in respect to national income levels.

Wealth is often a hot topic of discussion in the high school years. Don't delay your discussion on family finances beyond the 5th grade. Your children need to understand the exact circumstances in a realistic manner. It is not a time for boasting, complaining, it is a time for black and white analysis - here is our family budget, this is what we can afford, we live within our means, we currently live beyond our means. A general statement and understanding is needed - no matter what your family fortunes are.

Smart Phone Applications

Mobile applications allow you to see what you have spent by category and what you have spent spent verses your income into that account.

Mobile banking applications are a modern tool you cannot afford to live without.

Money Saving Tip

#9 Review your Budget Monthly, Weekly, Daily

Mobile applications have made checking your bank balances very convenient. Literally your balances are delivered right to the palm of your hand. Yes, it takes some set up and security measures but the time for the set up is rewarded with a great convenience.

Many online applications such as Mint give you more information than you could ever need or want. Mint delivers to my phone a convenient screen of not just my balances but also an overview of what I have spend and what I have deposited into that account.

Mobile applications for your bank balances is a modern tool you cannot afford to live without.

Money Saving Tip - Plan Your Taxes

Money Saving Tip

#10 Plan Your Taxes

Don't wait until the new year to review your finances and taxes. I prefer to sit down just after the third quarter and before the fourth quarter of the year before and estimate my final income and taxes.

DO plan your so your taxes don't plan you.

Income Tax System

10 Simple Steps to Saving Money

10 Simple Steps to Saving Money Summary

#1 Limit eating out.

#2 Pay off your credit card.

#3 Invest in your home in moderation.

#4 Never pay for a service that can obtain for free.

#5 Don't Use a Coupon for Something You Don't Need

Don't let coupons dictate your purchasing decision.

>>>Do plan your purchases>>>

#6 Shop early to shop frugally.

>>>DO comparison shop>>>

#7 Schedule time for returns.

>>>DO learn the return policy before you buy or bid>>>

#8 Learn and understand the important personal financial ratios.

#9 Review your budget monthly, weekly, daily.

>>>DO use a mobile application to track your bank balances>>>

#10 Plan Your Taxes.

>>>>>>>>Do plan your taxes so your taxes don't plan you.

Share Your Thoughts

Did you learn anything to take away and start saving today?

HubPages is a great website community. It is more than just articles and information, it is a great online community. If you are not a member...

Share This and Rate It Up

If you found these 10 simple tips helpful with your personal finances, please feel free to share it with your friends and family and/or rate it up.

© 2011 Ken Kline